Steps To Financial Turnaround for a Business

By the time an organization is confronting a financial turnaround, it has likely waited too long to initiate mitigating action and a series of missteps have led to company-wide pain. The cleanest and quickest approach to course correction is for the company-in-crisis to hire a consultant who can apply a fresh perspective to a tailored turnaround plan.

Though each organization is a unique composition of personnel, practices, policies, and intellectual property, turnarounds take a similar form. At Navitance, our Chief Restructuring Officers (CROs) quickly assess performance issues and market dynamics to identify the destabilizing causes and develop a step-by-step plan for corporate renewal, guided by the following 4 phases:

- Stabilization: Beginning with a financial and operational triage, turnaround specialists work to instill confidence in stakeholders – ranging from investors to employees – that proactive steps are being taken to preserve and restore company value. Activities in this phase include developing liquidity forecasts and improving cash flow and vendor management to provide the time needed to assess turnaround next steps. [PWC]

- Assessment: Next, turnaround specialists appraise the avenues available to maximize the value of the turnaround plan through 3 complementary lenses: 1) business planning and financial forecasts, 2) financial alternatives and sensitivity analyses, and 3) key accounting considerations. Combined, these assessments reveal a comprehensive financial and strategic picture, uncovering the areas of greatest liability, which could range from bloated inventory to overextended debt to poor management to meaningful market shifts. Also revealed by this assessment are the key performance indicators the organization should closely monitor and manage to through turnaround and beyond.

- Implementation: Informed by the assessment phase, the turnaround specialist will recommend one of the following approaches: 1) restructure, 2) sell, or 3) exit.

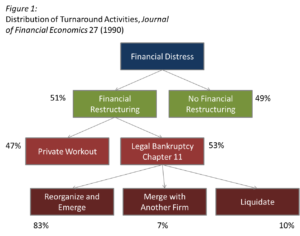

Figure 1 shows a historical distribution of turnaround activities. These activities can happen with or without legal bankruptcy, though bankruptcy restructuring can offer unique advantages. For example, bankruptcy can be used as a corporate finance tool within a sale or to reduce a firm’s overall debt load. However, in the case of the latter, it also exposes the company to equivalent taxable income. [Harvard Business School]

1 shows a historical distribution of turnaround activities. These activities can happen with or without legal bankruptcy, though bankruptcy restructuring can offer unique advantages. For example, bankruptcy can be used as a corporate finance tool within a sale or to reduce a firm’s overall debt load. However, in the case of the latter, it also exposes the company to equivalent taxable income. [Harvard Business School]

Based on the implementation path forward, turnaround specialists’ activities in this phase could include bankruptcy accounting and compliance, support with capital raises, capital optimization, debt restructuring and balance sheet de-leveraging, and credit advisory services.

- Ongoing Vigilance: After a turnaround has been successfully implemented, those transformational changes that resuscitated the organization should become guiding best practices and benchmarks. Before exiting the engagement, turnaround specialists should work with the organization to define the metrics of accountability, together building a blueprint for ongoing optimization – defined as revised internal practices and adaption to external market forces – to enable long-term success.

Like any major transition, a turnaround is disruptive, but not without value. Harvard Business School professor, Stuart Gibson, argues in his 2010 book, Creating Value through Corporate Restructuring: Case Studies in Bankruptcies, Buyouts, and Breakups, that a properly executed restructuring event can ultimately rejuvenate an organization through the hardnosed review and revision of financial, operational, and managerial strategies. Gibson also suggests that preemptive restructuring yields greater value than restructuring done under the threat of bankruptcy or a hostile takeover. [Harvard Business School]

While proactive measurers are best, we understand that sometimes trouble isn’t evident early on. Whether your firm is at the threshold of distress or you are seeking an outside perspective on financial fitness heading into the second half of the year, don’t hesitate to contact me at [email protected].